Renters Insurance in and around Norfolk

Norfolk renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

Trying to sift through coverage options and deductibles on top of managing your side business, your pickleball league and keeping up with friends, is a lot to deal with. But your belongings in your rented apartment may need the remarkable coverage that State Farm provides. So when trouble knocks on your door, your furniture, furnishings and tools have protection.

Norfolk renters, State Farm has insurance for you, too

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

Renters insurance may seem like last on your list of priorities, and you're wondering if it's really necessary. But imagine the cost of replacing all the valuables in your rented space. State Farm's Renters insurance can help when thefts or accidents damage your valuables.

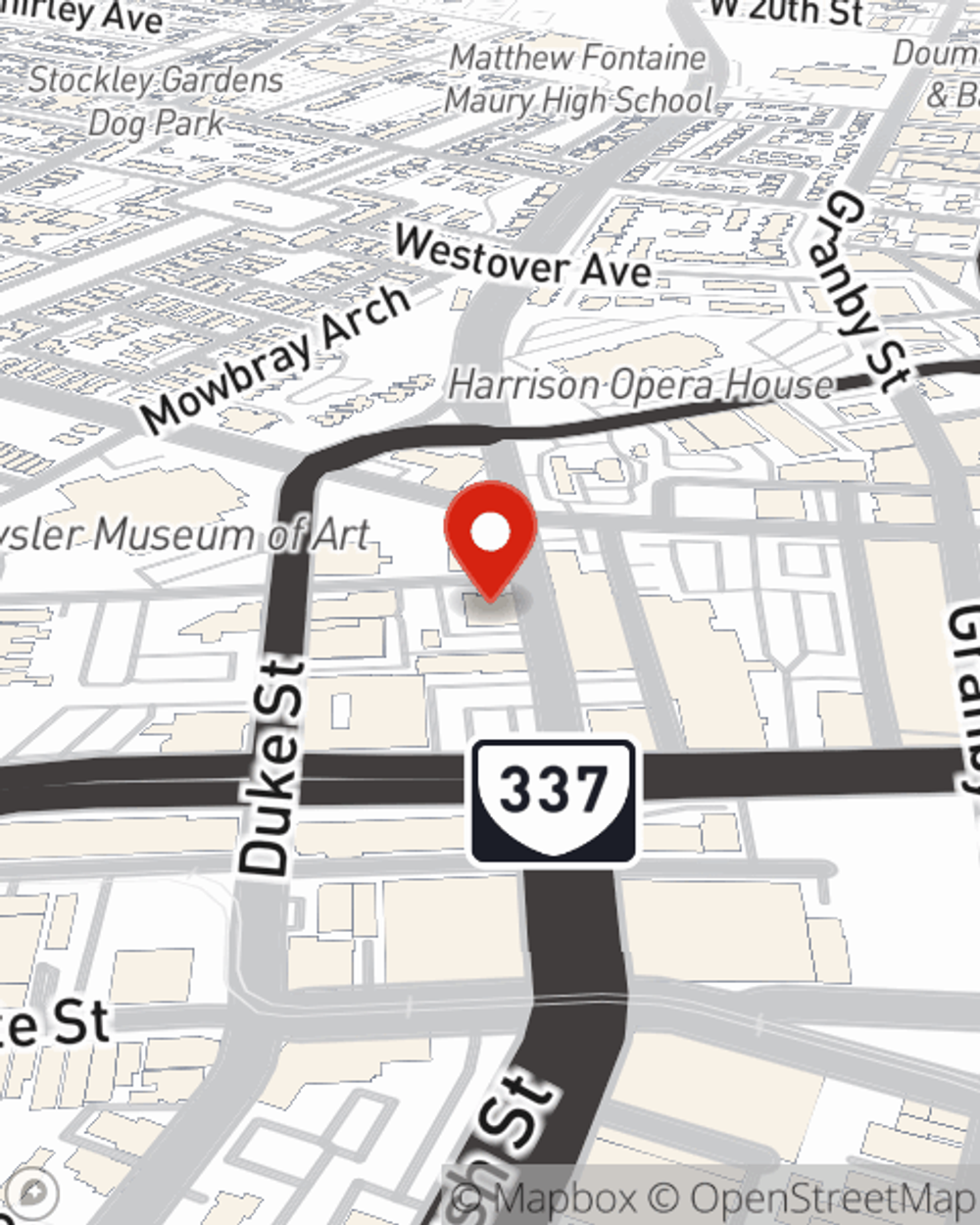

As a reliable provider of renters insurance in Norfolk, VA, State Farm is committed to keeping your home safe. Call State Farm agent Howard Jackson today and see how you can save.

Have More Questions About Renters Insurance?

Call Howard at (757) 648-8592 or visit our FAQ page.

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Howard Jackson

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.